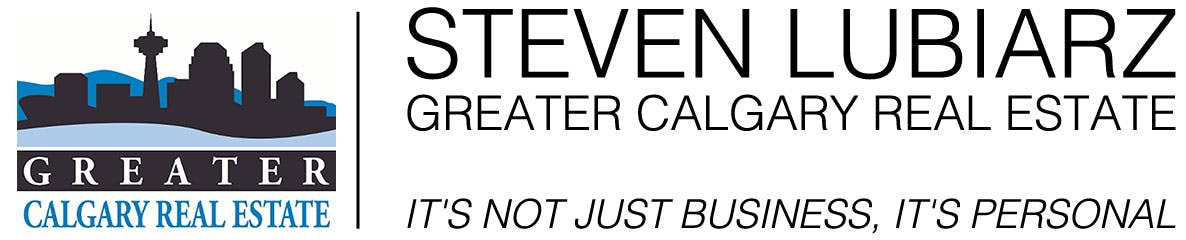

March sales rose to 2,664 units, a 10% year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84%, and the months of supply fell below one month.

Continue reading →calgary market insider yyc

Calgary Market Insider March 2024

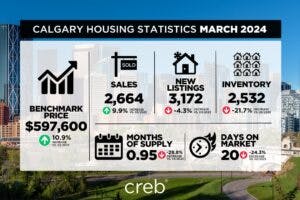

New listings continued to rise in February, reaching 2,711 units. However, the rise in new listings supported further growth in sales, which increased by nearly 23% compared to last year for a total of 2,135 units. The shift in sales and new listings kept the sales-to-new listings ratio exceptionally high at 79%, ensuring inventories remained near historic lows. Low supply and higher sales caused the months of supply to fall to just over one month, nearly as tight as levels seen during the spring of last year.

Continue reading →

Calgary Market Insider February 2024

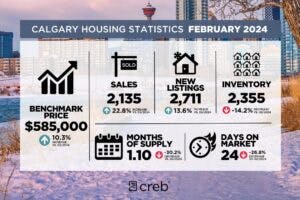

January sales rose to 1,650 units, a significant gain over last year’s levels and long-term trends. The growth was possible thanks to a rise in new listings totalling 2,137 units in January. New listings rose for homes priced above $300,000, but the largest gains occurred for homes priced above $700,000.

Continue reading →

Calgary Market Insider January 2024

Sales in 2023 did ease relative to last year’s peak, but with 27,416 sales, levels were still far higher than long-term trends and activity reported before the pandemic. While sales stayed relatively strong, there was a notable shift in activity toward more affordable apartment condominiums style homes.

Continue reading →

Calgary Market Insider November 2023

October sales activity slowed over the last month in alignment with typical seasonal patterns. However, with 2,171 sales, levels were 17% higher than last year and amongst the highest levels reported for October. Sales activity has been boosted mainly through gains in apartment condominium sales as consumers seek affordable housing options during this period of high-interest rates.

Continue reading →

Calgary Market Insider October 2023

Sales reached another record high in September with 2,441 sales. Despite the year-over-year gains reported over the past four months, year-to-date sales are still nearly 12% lower than last year’s levels. New listings also improved this month compared to last year and relative to sales. This caused the sales-to-new listings ratio to fall to 76%, preventing further monthly declines in inventory levels.

Continue reading →

Calgary Market Insider June 2023

Thanks to a significant gain in apartment condominium sales, May sales rose to 3,120, a new record high for the month. While the monthly gains have not outweighed earlier declines, this does reflect a shift from the declines reported at the start of the year.

Continue reading →

Calgary Market Insider April 2023

Sales and new listings have improved over the levels reported at the beginning of the year. As a result, the spread between sales and new listings supported some expected monthly inventory level gains. However, the 3,233 available units reflected the lowest March inventory levels since 2006 and left the months of supply just above one month, firmly in the seller’s territory. While conditions are not as tight as last March, low inventory levels leave purchasers with limited choice, once again driving up home prices.

Total unadjusted residential home prices reached $541,800 in March, a 2% gain over last month and nearly 1% higher than prices reported last year. While prices remain below the May 2022 high of $546,000, the pace of price growth over the first quarter has been stronger than expected due to the persistent seller’s market conditions.

Continue reading →

Calgary Market Insider March 2023

Consistent with typical seasonal behavior sales, new listings and inventory levels all trended up compared to last month. However, with 1,740 sales and 2,389 new listings, inventory levels improved only slightly over the last month and remained amongst the lowest February levels seen since 2006.

Continue reading →

Calgary Market Insider February 2023

The level of new listings in January fell to the lowest levels seen since the late 90s. While new listings fell in nearly every price range, the pace of decline was higher for lower-priced properties.

At the same time, sales activity did slow compared to the high levels reported last year but remained consistent with long-term trends. However, there has been a shift in the composition of sales as detached homes only comprised 47% of all sales.

Continue reading →