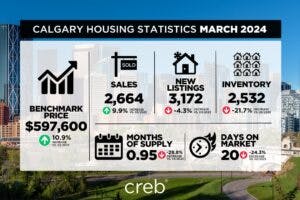

March sales rose to 2,664 units, a 10% year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84%, and the months of supply fell below one month.

Continue reading →calgary home stats

Calgary Market Insider March 2024

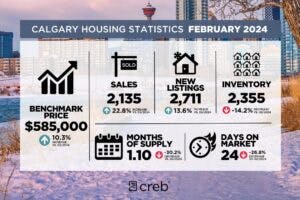

New listings continued to rise in February, reaching 2,711 units. However, the rise in new listings supported further growth in sales, which increased by nearly 23% compared to last year for a total of 2,135 units. The shift in sales and new listings kept the sales-to-new listings ratio exceptionally high at 79%, ensuring inventories remained near historic lows. Low supply and higher sales caused the months of supply to fall to just over one month, nearly as tight as levels seen during the spring of last year.

Continue reading →

Calgary Market Insider January 2024

Sales in 2023 did ease relative to last year’s peak, but with 27,416 sales, levels were still far higher than long-term trends and activity reported before the pandemic. While sales stayed relatively strong, there was a notable shift in activity toward more affordable apartment condominiums style homes.

Continue reading →

Calgary Market Insider December 2023

New listings in November reached 2,227 units, nearly 40% higher than the exceptionally low levels reported last year at this time. Gains in new listings occurred across most price ranges, but the most significant gains occurred from homes priced over $600,000.

Continue reading →

Calgary Market Insider November 2023

October sales activity slowed over the last month in alignment with typical seasonal patterns. However, with 2,171 sales, levels were 17% higher than last year and amongst the highest levels reported for October. Sales activity has been boosted mainly through gains in apartment condominium sales as consumers seek affordable housing options during this period of high-interest rates.

Continue reading →

Calgary Market Insider October 2023

Sales reached another record high in September with 2,441 sales. Despite the year-over-year gains reported over the past four months, year-to-date sales are still nearly 12% lower than last year’s levels. New listings also improved this month compared to last year and relative to sales. This caused the sales-to-new listings ratio to fall to 76%, preventing further monthly declines in inventory levels.

Continue reading →

Calgary Market Insider September 2023

Thanks to a surge in the condominium market, August sales reached a record high with 2,729 sales. Despite the record levels reported over the past several months, year-to-date sales are still down by 15% compared to last year.

While new listings did improve compared to levels seen this time last year, the sales-to-new-listings ratio remained elevated at 87%, preventing any significant shift from the low inventory situation. Inventory levels in August dropped to 3,254 units, not only a record low for the month but well below the 6,000 units that are typically available. Low inventory combined with high sales this month ensured the months of supply remained low at just over one month.

Continue reading →

Calgary Market Insider August 2023

Rising rates had little impact on sales this month as the 2,647 sales represented a year-over-year gain of 18%, reflecting the strongest July levels reported on record. The record-setting pace has been driven mainly by significant gains in the relatively affordable apartment condominium sector. Despite recent gains, year-to-date sales have declined by 19% over last year.

Continue reading →

Calgary Market Insider July 2023

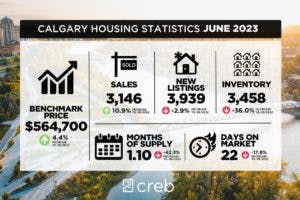

The housing market in Calgary witnessed a surge in apartment condominium sales, setting a new total residential record with 3,146 sales achieved in June. Although year-to-date sales are currently 23% lower than last year, they remain significantly higher than pre-pandemic levels.

Continue reading →

Calgary Market Insider June 2023

Thanks to a significant gain in apartment condominium sales, May sales rose to 3,120, a new record high for the month. While the monthly gains have not outweighed earlier declines, this does reflect a shift from the declines reported at the start of the year.

Continue reading →