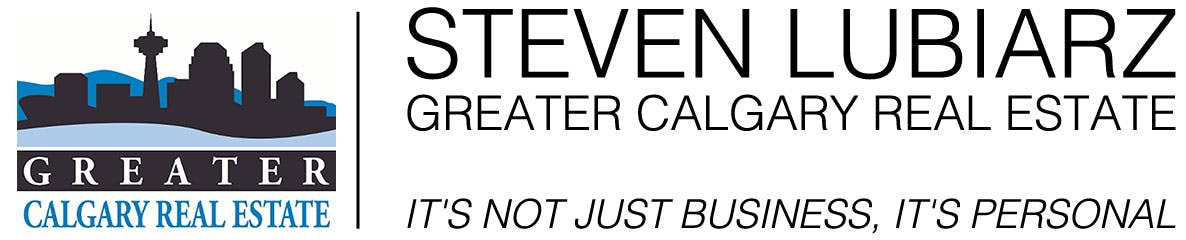

March sales rose to 2,664 units, a 10% year-over-year gain and much higher than long-term trends. While new listings did pick up over last month, the 3,172 units were still below what we typically see in March and not enough relative to sales to drive any change in the supply situation. In March, the sales-to-new listings ratio rose to 84%, and the months of supply fell below one month.

Continue reading →Blog

Calgary Market Insider March 2024

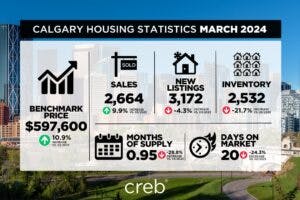

New listings continued to rise in February, reaching 2,711 units. However, the rise in new listings supported further growth in sales, which increased by nearly 23% compared to last year for a total of 2,135 units. The shift in sales and new listings kept the sales-to-new listings ratio exceptionally high at 79%, ensuring inventories remained near historic lows. Low supply and higher sales caused the months of supply to fall to just over one month, nearly as tight as levels seen during the spring of last year.

Continue reading →

Calgary Market Insider February 2024

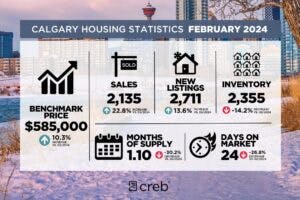

January sales rose to 1,650 units, a significant gain over last year’s levels and long-term trends. The growth was possible thanks to a rise in new listings totalling 2,137 units in January. New listings rose for homes priced above $300,000, but the largest gains occurred for homes priced above $700,000.

Continue reading →

Calgary Market Insider January 2024

Sales in 2023 did ease relative to last year’s peak, but with 27,416 sales, levels were still far higher than long-term trends and activity reported before the pandemic. While sales stayed relatively strong, there was a notable shift in activity toward more affordable apartment condominiums style homes.

Continue reading →

Calgary Market Insider December 2023

New listings in November reached 2,227 units, nearly 40% higher than the exceptionally low levels reported last year at this time. Gains in new listings occurred across most price ranges, but the most significant gains occurred from homes priced over $600,000.

Continue reading →

3 Ways to Avoid Overpaying in Alberta’s Seller’s Market

With housing inventory in Alberta at its lowest since 2006, overbidding is a natural consequence of the supply/demand lever. Here’s how you can avoid it.

By Brett Surbey | 3 minute read

Overbidding is becoming an issue in major metro areas in Alberta, like Calgary and Edmonton.

The Alberta housing market is gearing up to be a seller’s paradise this fall, with September inventory levels at their lowest since 2006, according to the Alberta Real Estate Association. This combination of low inventory and limited growth in new listings has kept Alberta’s sales-to new-listings ratio (S/NL) high: it currently sits around 71%. Some areas, such as Calgary and Red Deer, have even higher year-to-date S/NL percentages—clocking in at 79% and 80%, respectively.

This concoction of low inventory and persistent demand means homebuyers likely will compete for a piece of the real estate pie. But how can homebuyers avoid paying well over the value of a home or financially extend themselves?

“Sometimes people do go into the process of purchasing and get a little too excited.”

1. Know Your Limits

“Emotion comes to play in all of this,” says Steven Lubiarz, a realtor and certified condo specialist with Greater Calgary Real Estate. In his experience, he knows people get excited about buying a home, but understanding their budget before taking the purchase leap is critical. “We have to stay level headed about things and say, ‘Look I can only afford so much.’ Going above that [financial threshold] is when people get into trouble.”

Lubiarz notes that while understanding your top price point is important, homebuyers should not forget non-economic factors too — like their priorities, goals, property location and community. Sometimes, these factors outweigh the price considerations and waiting might be the best option. “There will be homes that come up. The market is cyclical and it will change. If people have patience and fortitude, it’s doable,” he tells Wahi.

2. Get Your Ducks in a Row

Getting prepared for a potential offer, rather than diving in headfirst, can be a tough pill to swallow, especially in a scarce market. Eager homebuyers can quickly feel like they’re missing out on potential homes by not putting an offer in as soon as possible. In a market like this, Lubiarz knows the feeling — but also knows to act against it.

“Sometimes people do go into the process of purchasing and get a little too excited: they don’t have any pre-approvals or they haven’t done their due diligence, which unfortunately might be a time waster for both seller and buyer,” Lubiarz notes.

3. Find Points of Leverage

Just because you can’t compete on price doesn’t mean you don’t have anything else to enhance your offer, Lubiarz has noticed in his practice. While price point is one of the major factors in a market like this, the Calgary realtor thinks that there are other factors worth considering, such as conditions.

“You can try to have as few conditions as possible,” Lubiarz recommends. And he’s even seen some buyers going into purchases with no conditions whatsoever in an effort to put their best foot forward. Lubiarz personally does not recommend this to clients because, “there’s a possibility you’re purchasing a home without a home inspection.” It’s important buyers know exactly what they’re getting into, regardless of the cost.

A more moderate option is to shorten the timeframe for conditions that you have in place, like financing or a home inspection. In cases of home inspections in particular, Lubiarz notes that, “[Closing] the gap between the time that you’re going to put a condition date and when the condition is due” can make your offer more favourable to sellers.

For those who have the liquidity, another strategy is to put down a larger deposit that makes up some of the purchase price, or even a secondary deposit. “This shows good faith,” Lubiarz says. Additionally, buyers could also divide their deposits into two payments, split between after the offer acceptance and after conditions have been waived, he explains. These bona fide acts can potentially highlight a willingness to be a good business partner in a market saturated with talk of dollars and cents.

Lubiarz recounts one of his clients sending a personal letter to the seller, indicating they had received pre-approval for financing. Sometimes, thinking outside of the box of economics can go a long way.

Brett Surbey

Wahi Writer

Calgary Market Insider November 2023

October sales activity slowed over the last month in alignment with typical seasonal patterns. However, with 2,171 sales, levels were 17% higher than last year and amongst the highest levels reported for October. Sales activity has been boosted mainly through gains in apartment condominium sales as consumers seek affordable housing options during this period of high-interest rates.

Continue reading →

Calgary Market Insider October 2023

Sales reached another record high in September with 2,441 sales. Despite the year-over-year gains reported over the past four months, year-to-date sales are still nearly 12% lower than last year’s levels. New listings also improved this month compared to last year and relative to sales. This caused the sales-to-new listings ratio to fall to 76%, preventing further monthly declines in inventory levels.

Continue reading →

Calgary Market Insider September 2023

Thanks to a surge in the condominium market, August sales reached a record high with 2,729 sales. Despite the record levels reported over the past several months, year-to-date sales are still down by 15% compared to last year.

While new listings did improve compared to levels seen this time last year, the sales-to-new-listings ratio remained elevated at 87%, preventing any significant shift from the low inventory situation. Inventory levels in August dropped to 3,254 units, not only a record low for the month but well below the 6,000 units that are typically available. Low inventory combined with high sales this month ensured the months of supply remained low at just over one month.

Continue reading →

Calgary Market Insider August 2023

Rising rates had little impact on sales this month as the 2,647 sales represented a year-over-year gain of 18%, reflecting the strongest July levels reported on record. The record-setting pace has been driven mainly by significant gains in the relatively affordable apartment condominium sector. Despite recent gains, year-to-date sales have declined by 19% over last year.

Continue reading →